Couples and the Age Pension: Why It’s Not Always 50/50

Navigating the Age Pension application process as a couple can be more complicated than many Australians expect. If you and your partner are approaching retirement, it’s essential to understand how Age Pension eligibility is assessed, and why entitlements between partners are not always split evenly.

In this guide, we explore how couples are assessed by Centrelink, why the Age Pension isn’t always divided 50/50, and how working with a pension advisor for seniors can help you maximise your Age Pension benefits.

How Are Couples Assessed for the Age Pension?

When you apply for the Age Pension in Australia, Centrelink looks at both partners' income and assets to determine eligibility and payment rates. Whether you’re married or in a de facto relationship, Centrelink considers you a member of a couple if you:

Live together or are financially interdependent,

Share financial responsibilities, and

Present as a couple socially.

Even if you're living apart due to illness or aged care needs, you may still be considered a couple, unless you apply for the 'separated due to illness' rate with Centrelink.

If you need Centrelink Age Pension help understanding how these definitions apply to your situation, an Age Pension consultant can guide you through the process and help ensure you’re assessed correctly.

Age Pension Rates: Couples vs Singles

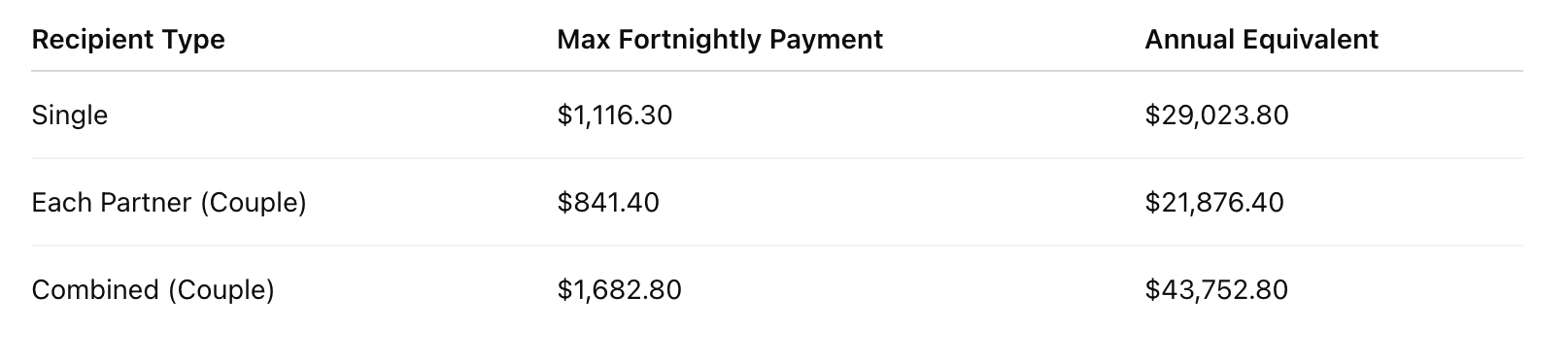

A common surprise for retirees is that the Age Pension payment for couples is less per person than the single rate. That’s because Centrelink assumes couples share expenses like rent, food, and utilities.

Here’s how the maximum fortnightly payments currently compare:

While you might expect a 50/50 pension split, the amount each person receives can vary depending on personal circumstances.

Why Payments May Differ Between Partners

Here are some reasons why couples might not receive the same pension amounts:

1. Unequal Superannuation or Income

Even though Centrelink uses combined income and assets to assess eligibility, Age Pension payments are made to individuals. If one partner has significantly more income from superannuation or investments, their personal payment may be reduced.

2. One Partner Still Working

If one of you is still earning income, their Age Pension may be reduced under the income test, even while the other partner receives a full entitlement. The Work Bonus may help, but accurate reporting is essential.

3. Living Separately Due to Health

Couples who are separated due to illness or aged care placement can apply for the higher single pension rate. If approved, this can increase your combined payments but requires a formal application through Centrelink.

4. Different Pension Start Dates

If one partner reaches Age Pension age before the other, only the older partner will receive a payment until the younger becomes eligible.

Get Help With Your Age Pension Application

Completing the Age Pension form and gathering supporting documents can be overwhelming, especially when Centrelink rules vary depending on your relationship status, income structure, and living arrangements.

That’s where our Age Pension application service comes in.

We offer:

Age Pension Consultation tailored to your circumstances

Centrelink Age Pension support including form completion and submission

Assistance with Age Pension eligibility checks

Strategies to maximise Age Pension benefits as a couple

A complete Age Pension Support Package designed for seniors

Ongoing advocacy if you’re dealing with Centrelink delays or issues

Whether you need help with your Age Pension application, or want to restructure your finances for better outcomes, our expert Age Pension consultants are here to help.

Final Thoughts

When it comes to couples and the Age Pension in Australia, it’s not always as simple as a 50/50 split. Understanding how Centrelink calculates your entitlements—and how to legally optimise them—can make a meaningful difference to your retirement income.

If you’re ready to apply for Age Pension assistance, or need guidance from a professional pension advisor for seniors, don’t do it alone.

✅ Book Your Age Pension Consultation Today

Let us take the stress out of your Centrelink Age Pension application. Whether you're just getting started or have already applied and need support, our team provides expert, personalised Age Pension advice every step of the way.

📞 Call us now or 📩 book online to get started with your Age Pension application support package.