Income Test vs. Assets Test: Which One Matters More for Your Age Pension?

Navigating the Centrelink Age Pension is one of the most significant financial steps you will take in retirement. The process can seem overwhelming, largely due to the two primary hurdles that determine your eligibility and payment rate: the Income Test and the Assets Test.

If you're like most of our clients, you've probably wondered: Which one should I be more worried about?

The truth is, both tests are equally important because Centrelink uses a rule known as the "Means Test."

⚖️ The Golden Rule: The Lowest Rate Applies

Centrelink doesn't just look at one test or the other. When you apply for the Age Pension, Services Australia assesses you under both the Income Test and the Assets Test.

They then use the test that results in the lowest amount of Age Pension payment.

This means you must pass both tests to be eligible for the full Age Pension, and your payment will be limited by whichever threshold you exceed the most.

Think of it like two gates you must walk through to get your payment. If the Income Gate is narrow but the Assets Gate is wide, the narrow gate (the Income Test) is the one that ultimately restricts your payment.

💰 The Income Test: How Your Earnings Are Assessed

The Income Test assesses your total income from all sources. Crucially, Centrelink often doesn't look at the actual return you get from your savings and investments; they use a system called Deeming.

What Counts as Income?

Employment Income (wages, self-employment, etc., though the Work Bonus provides significant concessions)

Deemed Income from financial assets (savings, shares, term deposits, managed funds, etc.)

Rental Income (from investment properties)

Superannuation Income Streams (most account-based pensions are deemed)

Overseas Pensions

The Key Reductions:

If your assessable income is above the income free area (the amount you can earn before your pension is affected), your Age Pension payment is reduced.

For a single person, the pension generally reduces by 50 cents for every dollar of income over the limit.

For a couple, the combined pension reduces by 25 cents for each partner for every dollar of combined income over the limit.

🏠 The Assets Test: Valuing What You Own

The Assets Test assesses the total value of what you own. Unlike the Income Test, which is calculated fortnightly, the Assets Test is based on the current market value of your property and possessions.

What Counts as an Asset?

Financial Assets (savings, shares, managed funds, super if you are Age Pension age)

Investment Property

Vehicles, Caravans, and Boats

Household Contents and Personal Effects (often assessed as a lump sum estimate)

The Great Exception: Your Home

The most significant exclusion is generally your Principal Place of Residence (the family home). If you own the home you live in, its value is exempt from the Assets Test. This is why the asset limits are significantly different for homeowners versus non-homeowners.

The Key Reductions:

If your assessable assets are above the assets free area for your situation (homeowner vs. non-homeowner, single vs. couple), your Age Pension payment is reduced by $3 per fortnight for every $1,000 in assets above the limit.

Which Test is Your Limiting Factor?

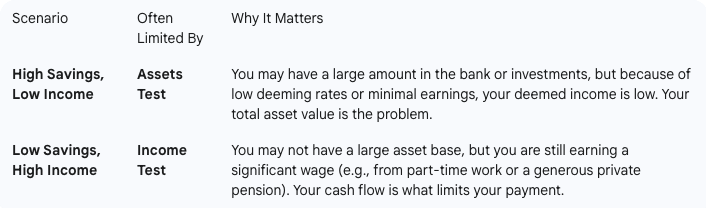

In our experience assisting Australian seniors, we find that people tend to fall into one of two groups:

There is no single answer to "Which one matters more?" The test that matters most is the one that gives you the lower pension rate.

Ready to Streamline Your Application?

The Age Pension Means Test is a complex, ever-changing mechanism. Making a mistake in how you calculate or report your assets or income can lead to:

A lower pension payment than you are entitled to.

A significant Centrelink debt that must be repaid.

Lengthy delays in your application processing.

At Age Pension Services, our specialists are experts at navigating the intricate rules of the Income and Assets Tests. We can analyse your unique financial situation and help ensure your application is submitted correctly, maximising your entitlements from day one.

Don't leave your retirement income to chance.