Investing While on Age Pension: Best Low-Risk Options That Won't Trigger Deeming Cuts

Retirement should be a time of relaxation, not financial stress. If you’re receiving the Age Pension in Australia, you know how important it is to grow your savings without reducing your fortnightly payments.

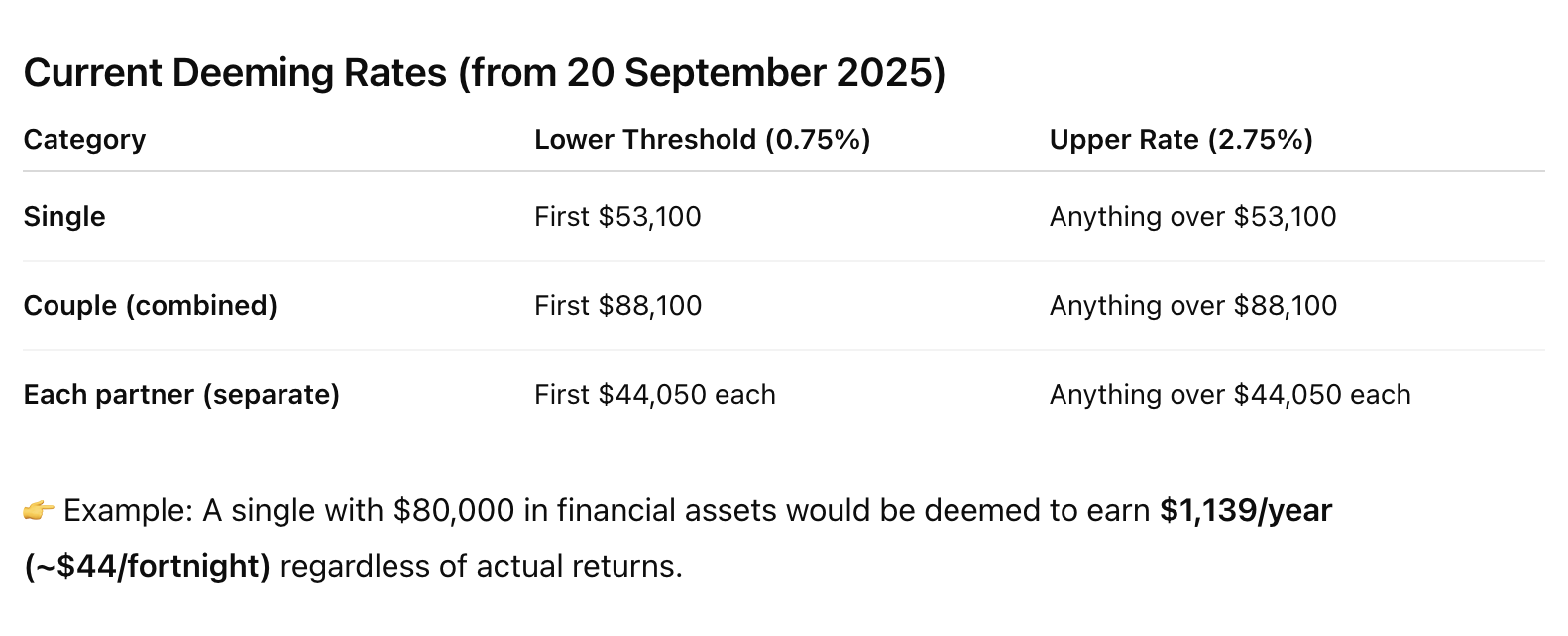

The challenge? Centrelink’s deeming rules—which apply fixed income rates to your financial assets when assessing your pension. With new deeming rates effective from 20 September 2025, it’s more important than ever to structure your investments wisely.

In this article, we’ll explain the updated rules, outline three low-risk investment options—term deposits, shares, and ETFs—and share strategies to protect your pension while still growing your savings.

Quick Refresher: What Are Deeming Rates?

Deeming rates are fixed percentages used by Services Australia to calculate “deemed income” from your financial assets (bank accounts, super, shares, managed funds, etc.). This deemed income counts towards your pension income test.

If your income stays below the current thresholds ($204/fortnight for singles, $360/fortnight for couples), your pension is unaffected.

If you go over, your pension reduces by 50 cents for every $1 of excess income.

The upside? If your investments earn more than the deeming rate, the extra return doesn’t reduce your pension—meaning smart investing can give you more income than Centrelink assumes.

Low-Risk Investment Options

Here are three strategies that work well under the deeming system.

1. Term Deposits – Safe and Predictable

Fixed interest for 3–12 months.

Current returns: 4–5% p.a. (higher than deeming rates).

Protected up to $250,000 per bank under the Financial Claims Scheme.

Impact on deeming: Even if you earn 4.5%, Centrelink only deems 0.75–2.75%. The difference is yours to keep.

✔ Best for: Capital protection, emergency funds, and simple income.

2. Shares – Blue-Chip Dividend Payers

Large, established ASX companies (e.g. CBA, Woolworths).

Dividend yields: 4–6% p.a. (often with franking credits).

Impact on deeming: Actual dividends don’t count—only the deemed rate does. Franking credits add an extra tax benefit without affecting pension calculations.

✔ Best for: Long-term growth and reliable dividend income.

3. ETFs – Diversification Made Easy

Low-cost funds that track markets (e.g. Vanguard Australian Fixed Interest, iShares Core S&P/ASX 200).

Bond ETFs yield ~2–4%; equity ETFs ~4–5% returns.

Impact on deeming: Treated as managed funds. Only the deemed rate applies, not actual distributions.

✔ Best for: Hands-off investing with broad diversification.

Smart Strategies to Balance Growth and Pension

Barbell approach: 50–60% in term deposits for safety, 20–30% in shares/ETFs for growth.

Monitor thresholds: Stay under lower deeming thresholds where possible.

Use gifting rules: Up to $10,000/year ($30,000 over 5 years) to reduce assessable assets.

Leverage franking credits: Boost after-tax income without affecting deeming.

Annual review: Rebalance in line with rate changes and Centrelink rules.

👉 Done right, this mix can deliver 3–5% real returns while keeping your pension intact—adding thousands to your income each year.

Ready to Optimise Your Retirement?

The 2025 deeming changes could reduce your payments. But with the right planning, you can protect and even grow your retirement income.

At Age Pension Services, our $495 package includes:

Personalised asset reviews

Investment structuring

Centrelink compliance support

Because retirement should be about peace of mind—not paperwork.

DISCLAIMER: The information contained on this website has been provided as general advice only. The contents have been prepared without taking account of your objectives, financial situation or needs. You should, before you make any decision regarding any information, strategies or products mentioned on this website, consult your own financial advisor to consider whether that is appropriate having regard to your own objectives, financial situation and needs.